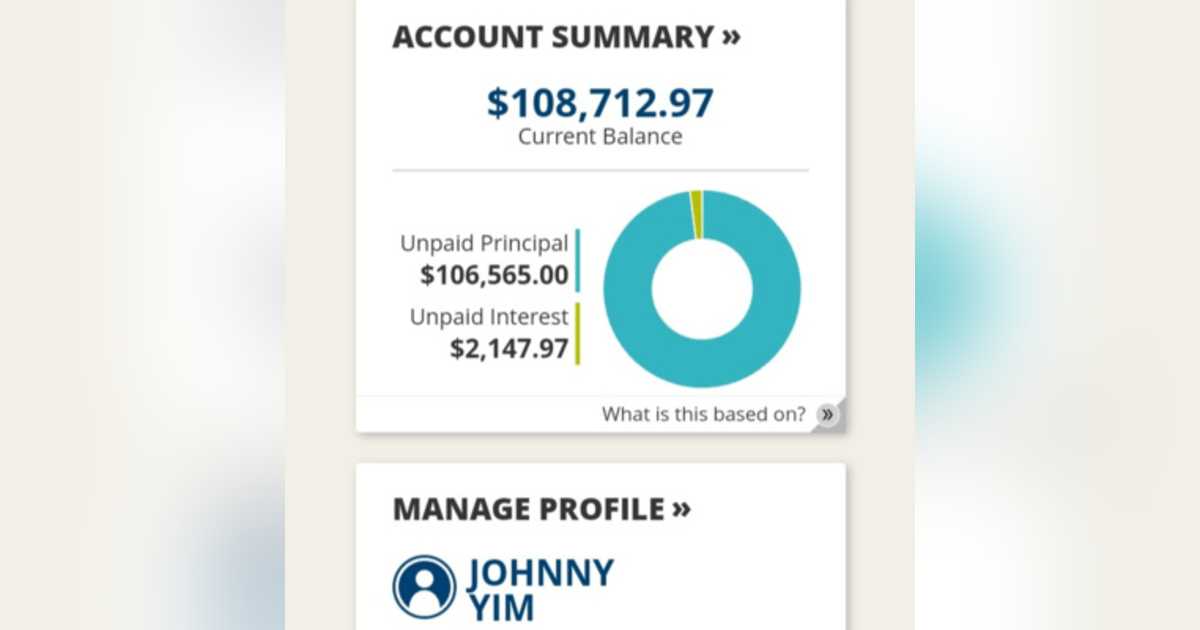

9. My Journey to Pay Off $124,000 in Debt in 5 Years (My Plan Came From 10 Financial Books)

This episode is a little different than my other episodes. The big takeaway from this episode is to apply what you learn from books to your life. In this episode, I discuss my plan that came from 10 financial books to pay off $124,000 in debt in 5 years. First, I had to do 4 financial moves before I started this journey. Now, I'm ready to pay off those student loans in 5 years. The books mentioned in the episode are: Total Money Makeover by Dave Ramsey; Automatic Millionaire and Start Late, Finish Rich by David Bach; Millionaire Next Door by Thomas Stanley; Everyday Millionaire by Chris Hogan; The Financial Diet by Chelsea Fagan and her podcast; Financial Freedom by Grant Sabatier; Your Score by Anthony Davenport; I Will Teach You to Be Rich by Ramit Sethi; and the Financial Feminist podcast by Tori Dunlap who has a book coming out on December 27th, 2022. I'm so excited for this book because it's going to be fire. For written reviews, check out my website: https://johnnysbookreviews.com/ For daily updates on what I read check out my Instagram, Facebook, or Goodreads: https://www.instagram.com/johnnysbookreviews/?hl=en, https://www.goodreads.com/user/show/58859323-johnnysbookreviews, and https://www.facebook.com/johnnysbookreviews/ For my merch: https://www.bonfire.com/store/johnnysbookreviews/ --- Support this podcast: https://podcasters.spotify.com/pod/show/johnnysbookreviews/support