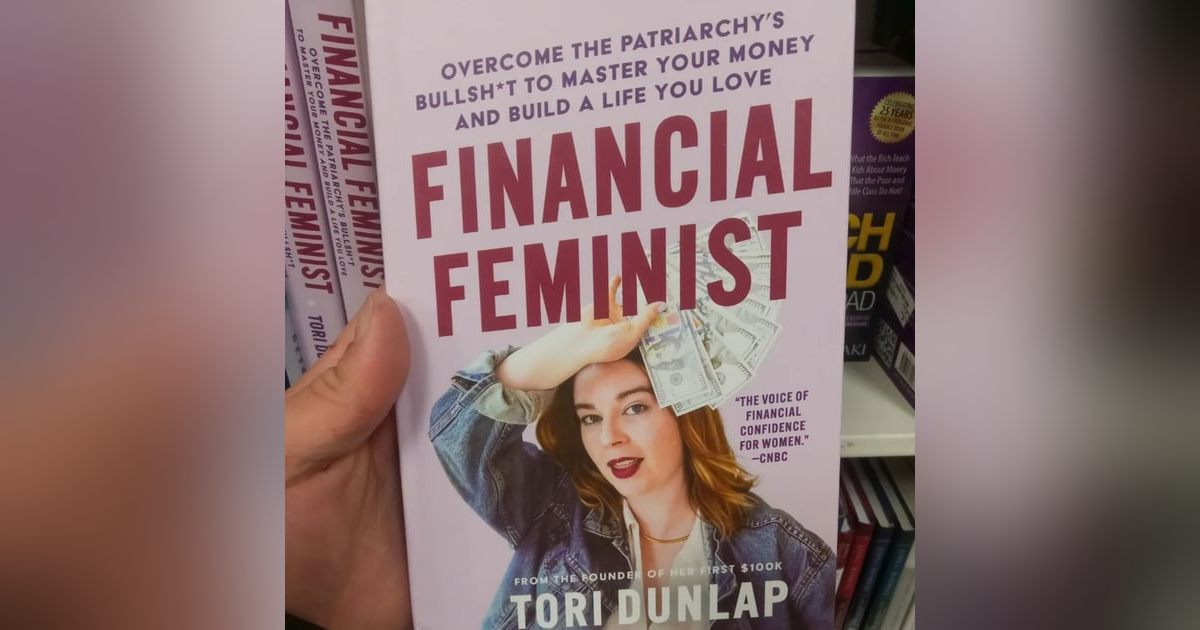

47. Financial Feminist by Tori Dunlap Book Review

Financial feminist is a financial guidebook to fix your finances now. There's no bias, no restrictions, but there's a way to fix your financial habits with this book. This is important as fixing your finances start with fixing your financial habits. This book addresses some of the problems with Total Money Makeover by Dave Ramsey, and these problems make sense. One of the big ones is a $1,000 emergency saving account that Ramsey promotes. This is a great start, but Tori mentions to strive for a bigger emergency account first (three to six months). This way you feel comfortable and are confident to start paying off debt if you have any and start investing. The other popular financial book is Rich Dad Poor Dad by Robert Kiyosaki. This book is advanced because it discusses financial moves like buying real estate you should do after you have established better financial habits. Robert doesn't mention any of that financial base first like an emergency account or debt, which I think are important. In this episode, I review Financial Feminist, discuss what I liked and disliked about the book, and any lessons I received from the book. I'll talk about credit card debt, emergency savings account, biking to work, and then why I'm probably not going to buy a house.

For written reviews, check out my website: https://johnnysbookreviews.com/ For daily updates on what I read check out my Instagram, Facebook, or Goodreads: https://www.instagram.com/johnnysbookreviews/?hl=en, https://www.goodreads.com/user/show/58859323-johnnysbookreviews, and https://www.facebook.com/johnnysbookreviews/ For my merch: https://www.bonfire.com/store/johnnysbookreviews/ For my book: https://a.co/d/ihqARJW